Case Study: Payroll

This case study outlines the design of a multi-network payroll system built to handle complex financial workflows for national mortgage organizations and franchise head offices.

Overview

An application being developed to unify payroll operations across multiple brokerage networks, each with its own legacy systems, processes, and operational constraints.

As Product Lead, I was responsible for defining and designing a platform that addressed long-standing issues shared across networks and simplifying fragmented workflows.

Challenge

The first challenge was learning the payroll domain and understanding how money actually moves through payroll systems. That surfaced a set of interrelated challenges:

- High financial complexity: Commissions, fees, allocations, splits, and taxes needed to be handled correctly across many scenarios

- Inconsistent network processes: Each network and admin team had developed its own workflows and systems over time

- Diverse stakeholder needs: Administrators, head office, and executives all required different levels of control and visibility

- Limited documentation: No dedicated Business Analysts, minimal reliable documentation, and no single source of truth

- Tight timelines and resources: Aggressive delivery expectations required careful prioritization and pragmatic design decisions

Together, these constraints meant the challenge extended far beyond UI design. It required rapidly learning a complex financial domain, aligning disparate operational models, and translating them into a single payroll platform multiple networks could rely on with confidence.

Approach

Once the domain was understood, the focus shifted to modeling payroll as a coherent financial system before designing any interfaces.

Key actions and decisions:

- Built domain knowledge in payroll, accounting, and reconciliation by working directly with stakeholders across each brokerage network

- Reviewed existing systems and workflows to identify friction points, manual workarounds, and safe opportunities to simplify

- Researched comparable payroll platforms and used AI tools to accelerate domain learning and validate assumptions

- Mapped the end-to-end flow of money to establish a clear system model

- Reviewed upstream origination and compliance systems to ensure payroll data flowed in cleanly and without ambiguity

- Assessed delivery risk early and expanded the team by vetting and hiring a senior front-end Angular engineer to bridge design and implementation

The guiding principle was to build a system that could handle financial complexity while remaining clear, reliable and scalable.

Solution

The payroll platform replaces fragmented, manual workflows with a unified system designed to manage financial complexity without sacrificing clarity.

Legacy Excel-heavy workflows were replaced with a structured template system, reducing daily administrative effort by an estimated 40% and significantly lowering the risk of human error.

The platform integrates with upstream origination and compliance systems so data flows cleanly into payroll and can be trusted as a single source of truth.

Financial data is stored in structured, reportable fields, enabling validation, filtering, and reporting that provide significantly greater visibility and operational control.

Process & Responsibilities

As Product Lead I owned the payroll project end to end:

- Led discovery and domain learning across payroll, accounting, and reconciliation workflows

- Worked directly with payroll administrators, interviewing and shadowing users to understand real workflows and pain points

- Mapped money movement across deposits, deals, allocations, fees, commissions, expenses, and taxes

- Defined scope and requirements, acting as the primary Business Analyst

- Designed the full UX flow in Figma and created high-fidelity prototypes supported by detailed Jira tickets

- Partnered closely with backend teams and a Product Manager on API design, data structures, and system integration

- Reviewed front-end architecture and implementation to ensure design intent carried through to production

The result is a payroll system that supports multiple roles and workflows within a single, consistent platform.

Selected Interfaces

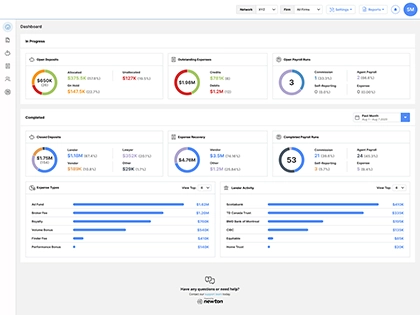

Operations Dashboard

Landing page for reviewing and managing in-flight and completed work.

- Clear separation between active and completed tasks

- At-a-glance visibility into open deposits, outstanding expenses, and active pay runs

- Date-based filtering for reviewing historical activity

- Horizontal bar charts showing expense types and lender activity by volume

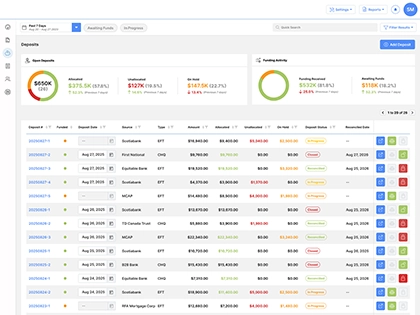

Deposits

Overview of all funding activity in the system.

- Clear breakdown of Open deposits by Allocated, Unallocated, and On Hold

- Visibility into Received vs Awaiting funds to help prioritize work

- Status-based indicators to surface deposits that need attention

- Actions enabled or disabled based on deposit status to prevent invalid steps

Allocate Deposit

Interface to support complex funding breakdowns.

- Deposit and deal details shown to confirm correct records

- Fields shown or hidden based on category and fee type to reduce noise

- Compliance-driven defaults and overrides make splits clear and understandable

- Consistent layout across allocation screens to keep the experience predictable

Pay Runs Dashboard

Overview of payroll runs and current progress.

- Breakdown of open runs by type and workload

- Separate views for Open and On Hold runs

- Structured listings with adjustment indicators and balances

- Filters and status indicators to quickly surface runs needing attention

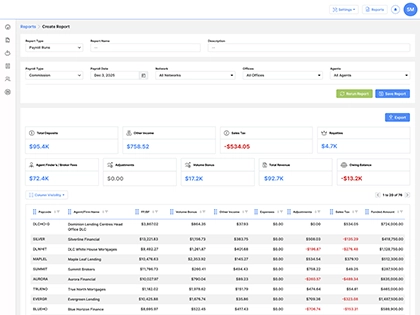

Create Report

Ad-hoc reporting for audits and operational review.

- Filters revealed based on report type to keep the interface focused

- Reports generated from finalized payroll data only

- Summary views for quick validation

- Configurable table outputs for customized exports

Outcomes & Impact

While still in rollout, the system is already making payroll work faster and more reliable. Imports are simpler, daily tasks require less manual effort, and keeping work inside the platform reduces errors caused by moving data between systems.

- Single payroll model: Network-specific processes are supported within one consistent system

- System-wide visibility: Unallocated funds, on-hold runs, and discrepancies are easy to identify

- Reduced reliance on tribal knowledge: Complex rules are embedded in the platform rather than applied manually

- Built for scale and audibility: Designed to support additional users, higher volumes, and formal audit requirements

Final Reflection

Payroll reinforced that meaningful change doesn’t come from forcing new workflows, but from understanding how people actually work. By addressing the highest-friction tasks and preserving the control users rely on, the system removes barriers to adoption rather than creating them.

The result is a platform people choose because it fits how they work, not because they’re expected to adapt to it.